Introduction

District Metals (TSXV: DMX) has announced a dramatic update to the resource estimate for its Viken project in central Sweden, positioning it as the world's second largest uranium deposit. The news, released on Tuesday, led to a 23% surge in the company's share price, reflecting strong market confidence in the project's potential.

Massive Resource Growth

The updated report for Viken reveals an almost ninefold increase in indicated uranium resources, now standing at 456 million tonnes grading 175 ppm uranium oxide (U₃O₈), equating to 176 million contained pounds. Inferred resources also grew by 44%, reaching 4.33 billion tonnes at 161 ppm U₃O₈ for 1.53 billion contained pounds. According to CEO Garrett Ainsworth, this growth underscores the consistency and thickness of the mineralized Alum Shale formation at Viken, with further potential to expand inferred resources.

Beyond uranium, Viken hosts substantial amounts of critical minerals like vanadium, zinc, and nickel. Indicated vanadium resources surged over 16 times to 2.85 billion pounds, while inferred vanadium grew by 45% to 24.29 billion pounds. Zinc and nickel resources also saw significant updates, adding to the project's strategic value.

Global Ranking and Context

While Viken is the largest uranium resource in Europe by contained metal, its global ranking as the second largest deposit depends on comparison metrics. District Metals positions Viken behind BHP’s Olympic Dam in South Australia, considering deposits where uranium is a primary or secondary metal. However, this ranking warrants scrutiny as different methodologies and data sources may yield varying results. The global uranium market is heating up, driven by demand for zero-emission energy sources, particularly for powering AI servers, which could further elevate Viken's importance.

Sweden’s Uranium Policy Shift

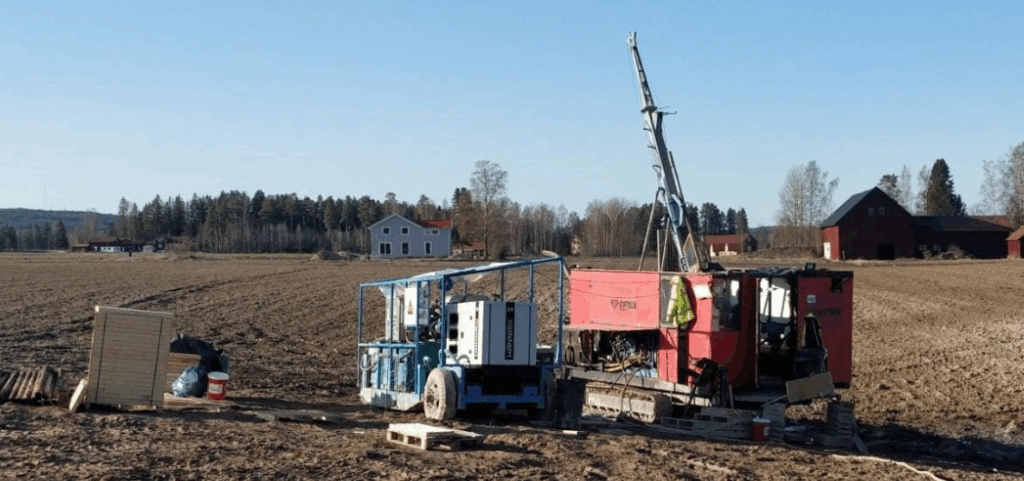

The timing of this resource update aligns with Sweden's move to lift its 2018 ban on uranium exploration and mining, expected to take effect in January 2025. Sweden holds 27% of Europe's uranium resources, and this policy shift could catalyze projects like Viken. District Metals is considering a preliminary economic assessment for Viken in Q4, contingent on these legislative changes.

Critical Analysis

While the resource update is impressive, questions remain about the economic viability of extracting uranium at Viken, given the relatively low grade of the deposit (175 ppm U₃O₈ in indicated resources). The project's success will hinge on favorable uranium prices, extraction costs, and environmental considerations, especially in a region sensitive to mining impacts. Additionally, the global ranking claim should be independently verified against other major deposits to ensure accuracy. Nonetheless, Viken's multi-mineral potential and Sweden’s policy shift position it as a key player in the critical minerals space.