Introduction

Graphite One (TSXV: GPH) announced on Wednesday a significant milestone for its US-based lithium-ion battery anode material supply project, reaching the feasibility stage well ahead of schedule. With plans for initial production in 2028, the company is now entering the permitting phase, bolstered by recent US government funding and support from the Department of Defense.

Project Overview and Reserve Growth

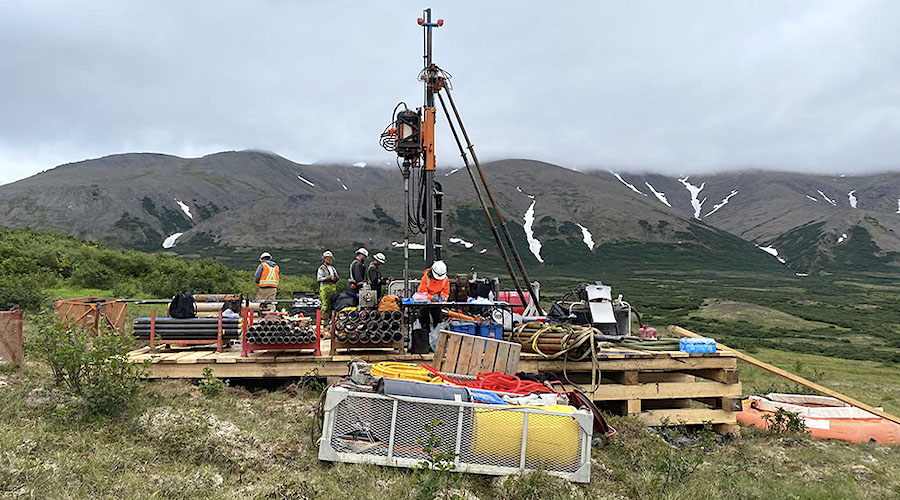

The integrated project aims to produce anode materials and other graphite products for the US market, utilizing natural graphite from the Graphite Creek deposit in Alaska and processing it at a proposed facility in Ohio. The feasibility study (FS) reflects a dramatic increase in reserves, with 71.2 million tonnes at 5.2% graphitic carbon (Cg), containing 3.7 million tonnes of graphite—over three times the amount reported in the 2022 pre-feasibility study (PFS). Measured and indicated resources also tripled to 104.7 million tonnes at 4.6% Cg. Notably, only 12% of the 15.3 km mineralized zone has been drilled, hinting at further potential.

The FS projects a mine life of 20 years, producing 175,000 tonnes per year of graphite concentrates starting in 2030, a sharp rise from the PFS estimate of 53,000 tonnes. Initial commercial production of 50,000 tonnes annually is targeted for 2028 using purchased graphite, with anode material output expected to scale from 48,000 tonnes to 169,000 tonnes by 2031. Financially, the project boasts a post-tax net present value (NPV) of $5 billion, an internal rate of return (IRR) of 27%, and a payback period of 7.5 years.

Strategic Importance and Market Response

CEO Anthony Huston highlighted the project's alignment with US critical mineral policies, including President Trump’s executive orders on critical minerals and Alaska. He emphasized Graphite One’s role in supporting transformative sectors like energy, transportation, AI infrastructure, and national defense. Following the announcement, the company’s stock rose 2.1% in Toronto, reaching a market capitalization of C$139 million ($100 million).

Analysis and Perspective

While the feasibility study paints an optimistic picture, several challenges remain. The ambitious timeline—permitting and construction of the Ohio facility within three years, followed by a modular buildout to full capacity by 2031—could face delays due to regulatory hurdles or unforeseen technical issues. Additionally, the reliance on purchased graphite for initial production in 2028 raises questions about supply chain stability and cost implications before the Graphite Creek mine comes online. On the positive side, the substantial reserve growth and strategic alignment with US policy underscore Graphite One’s potential to become a key player in the domestic critical minerals market. Investors should, however, monitor permitting progress and funding availability closely, as these will be critical to meeting the projected timeline.