Introduction

The United Kingdom is contemplating a national security review concerning the potential sale of two deep-sea mining exploration licences in the Pacific Ocean, as reported by the Financial Times. These licences, sponsored by the UK, are held by UK Seabed Resources (UKSR), a company acquired by Norway’s Loke Marine Minerals in 2023 from US defense contractor Lockheed Martin. Loke’s recent bankruptcy filing has triggered an auction of its assets, raising concerns over the transfer of these strategically significant licences.

Key Developments

- Bankruptcy and Auction: Loke Marine Minerals filed for bankruptcy earlier this month, leading to an auction of its assets, including the UKSR licences. This has prompted scrutiny from the UK government under the National Security Investment Act, which allows intervention in transactions posing security risks.

- Government Concerns: The Department for Business and Trade highlighted potential issues with foreign ownership, suggesting a restructuring of UKSR under a UK holding company to avoid complications. An email to Loke’s CEO, reviewed by FT, indicated that a Norwegian parent company could be “problematic.”

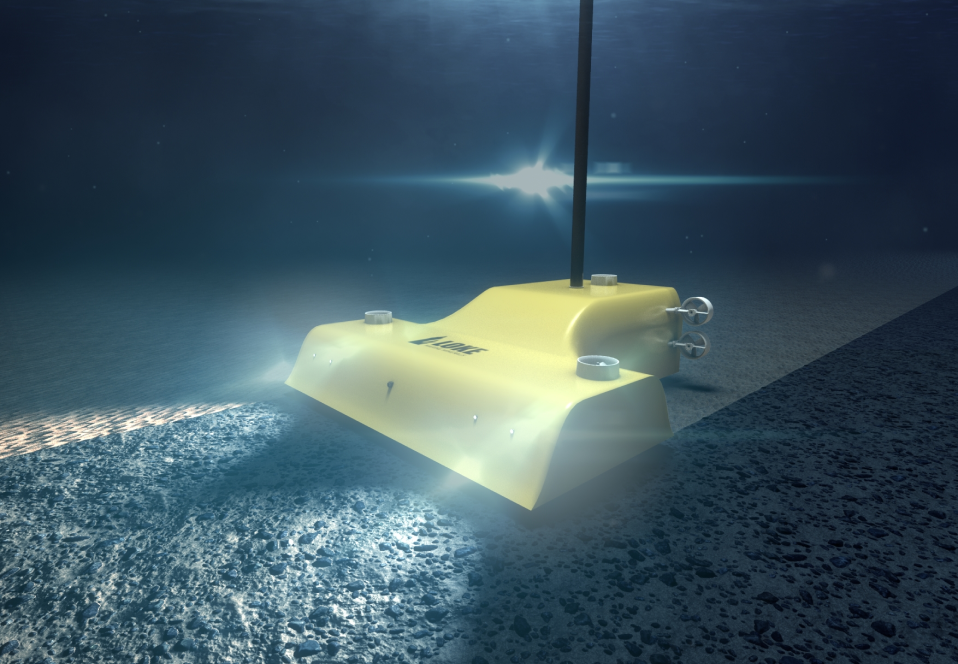

- Global Context: The sale occurs against a backdrop of growing international interest in critical minerals like nickel, cobalt, and copper, essential for battery production and found on the ocean floor. US President Donald Trump’s recent push for deep-sea mining adds pressure on allies to secure mineral supply chains, while China leads in the number of seabed mining licences.

- Regulatory and Environmental Challenges: The International Seabed Authority (ISA) warned UKSR of potential non-compliance with exploration terms, compounded by unpaid licence fees. Sources close to Loke blamed regulatory uncertainty and delays by ISA member states for the company’s financial struggles. Meanwhile, environmental concerns persist, with countries like the UK, France, and Germany remaining cautious, and groups like Greenpeace entering the auction as a protest against commercialization.

Analysis and Viewpoint

The potential transfer of these licences raises critical questions about national security and strategic interests, particularly given the involvement of foreign entities and the strategic importance of critical minerals. While the UK government’s invocation of the National Security Investment Act is a prudent step, it also highlights the tension between economic imperatives and environmental concerns. The suggestion to restructure UKSR under a UK holding company appears to be a pragmatic solution, but it risks being perceived as a protectionist move. Furthermore, Loke’s financial struggles underscore the broader challenges of deep-sea mining, including regulatory ambiguity and high capital costs. The involvement of Greenpeace, though symbolic, draws attention to the environmental risks that remain insufficiently addressed in international frameworks.

A key question remains: can the UK balance its strategic interests with the environmental and ethical implications of deep-sea mining? The delays in international regulation, as noted by sources close to Loke, suggest a systemic issue that could hinder sustainable development in this sector. Without clearer guidelines from bodies like the ISA, such controversies are likely to persist.