Introduction

The latest MINING.COM TOP 50 ranking reveals that the world's most valuable mining companies have achieved a combined market capitalization of $1.36 trillion as of mid-April 2025, marking a significant increase of $79.7 billion since the end of 2024. This growth comes amidst a volatile market influenced by fluctuating commodity prices and geopolitical uncertainties.

Key Trends in the Mining Sector

- Gold Stocks Shine: The surge in gold prices, reaching $3,420 per ounce, has propelled precious metal companies to dominate the best performers list. Companies like Newmont, Agnico Eagle, and South Africa’s Harmony Gold have seen remarkable gains, with Harmony jumping 24 spots to rank 37 after a 117% value increase since the end of 2024.

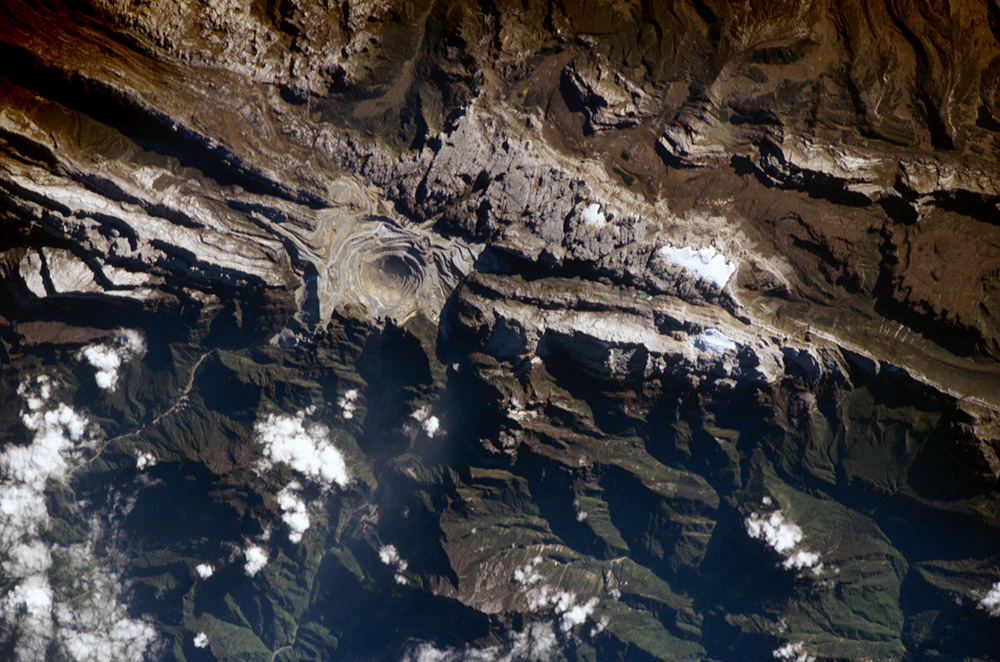

- Copper and Lithium Struggles: In contrast, copper producers and diversified companies with base metal portfolios lost a combined $53 billion by April 17, 2025, trading $205 billion below their September 2024 peak. Lithium representation in the ranking has dwindled to a single company, Chile’s SQM, as others like Albemarle saw significant declines.

- Market Volatility and New Entrants: The quarter saw six new entries into the Top 50, the highest in six years, reflecting market volatility partly due to trade war concerns and Trump’s tariff policies. Notable newcomers include Lundin Gold and Evolution Mining, while companies like Lundin Mining and South32 dropped out.

- Geographic Shifts: Canada has overtaken Australia in the value of headquartered mining companies, with 13 Canadian firms worth nearly $300 billion compared to $275 billion for eight Australian companies.

Analysis and Perspective

While the gold sector's performance is impressive, the sustainability of this rally raises questions. Gold’s record-breaking run may face challenges if profit-taking begins or if macroeconomic conditions shift. Conversely, the decline in copper and lithium valuations, though significant, might be temporary given the long-term demand for these critical minerals in the energy transition. The exclusion of state-owned enterprises and certain diversified firms from the ranking, while methodologically sound, may underrepresent the true scale of global mining activities, particularly in regions like China and Chile. A broader inclusion criterion could provide a more comprehensive view of the industry’s value.

Conclusion

The MINING.COM TOP 50 ranking underscores the divergent fortunes within the mining sector, with gold stocks providing a buffer against losses in copper and lithium. As market dynamics continue to evolve, investors and policymakers must balance short-term volatility with long-term strategic needs for critical minerals.