Introduction

Ascot Resources (TSX: AOT), a Vancouver-based mining company, has announced plans to restart production at its Premier gold project in northwestern British Columbia by early August. This follows the successful completion of a C$61.1 million ($44m) financing round, which will fund critical upgrades and operational enhancements at the historic mine site.

Funding and Operational Upgrades

The newly secured funds will address key operational bottlenecks, particularly the issue of power capacity at the Premier Northern Lights (PNL) workings. Ascot has ordered a new transformer to enable simultaneous operation of multiple pieces of equipment, a critical step toward efficient production. Additionally, the company plans to double the camp space at the Premier site to accommodate more personnel as it gears up for the restart.

The Premier mill is expected to resume operations at an initial rate of 1,250 tonnes per day (tpd), with feedstock sourced from both PNL and the Big Missouri deposit. This will be achieved by running the 2,500-tpd mill on a two-week-on, two-week-off schedule. Ascot anticipates ramping up to full capacity of 2,500 tpd seven days a week by the first half of 2026, once the Silver Coin deposit is developed.

Exploration and Market Response

In parallel with the restart preparations, Ascot will launch an exploration drilling program in June to evaluate prospective sites near the Premier mill and other high-elevation targets. However, despite the positive funding news, Ascot’s shares dropped 5.3% by mid-morning on the day of the announcement, resulting in a market capitalization of C$128 million ($92m).

Historical Context and Challenges

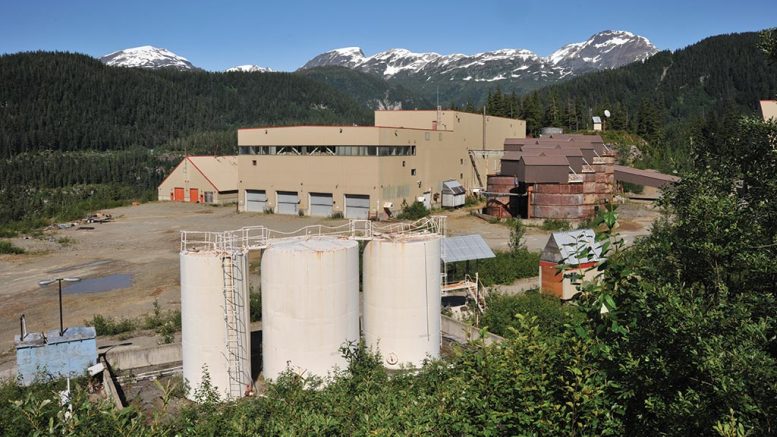

The Premier gold project, located 25 km from Stewart, BC, was once North America’s largest gold mine, producing 2 million ounces between 1918 and 1952 across four deposits. Acquired by Ascot from Boliden in 2018, the mine briefly returned to production last April but was halted after five months due to insufficient underground development. The company initially aimed for a Q2 2025 restart but had to adjust its timeline.

Editorial Analysis

While the secured funding and August restart target are promising, questions remain about the sustainability of Ascot’s operational strategy. The two-week-on, two-week-off milling schedule may help manage costs initially, but it could limit output and delay full capacity utilization. Furthermore, the 5.3% drop in share price suggests investor skepticism about the project’s near-term profitability or the feasibility of meeting the revised timeline. Ascot must demonstrate progress in underground development and power upgrades to rebuild market confidence.